Fast, flexible and freakin' awesome

Whether you're in the back office or on the go, securely pay your bills in no time. MarginEdge has the only payment solution built exclusively for restaurants, and it’s included with your [me] subscription at no extra charge.

Pay bills the way you want

Maintain good vendor relations and keep complete control of your cashflow with MarginEdge's flexible payment methods and options.

- Multiple methods - pay by check, by electronic payments, or use your fave credit card to defer payment and rack up the points

- Multiple options - create partial payments, schedule future payments or set it and forget it with AutoPay

- Send payment immediately (and upload your invoice later) if an urgent bill was overlooked

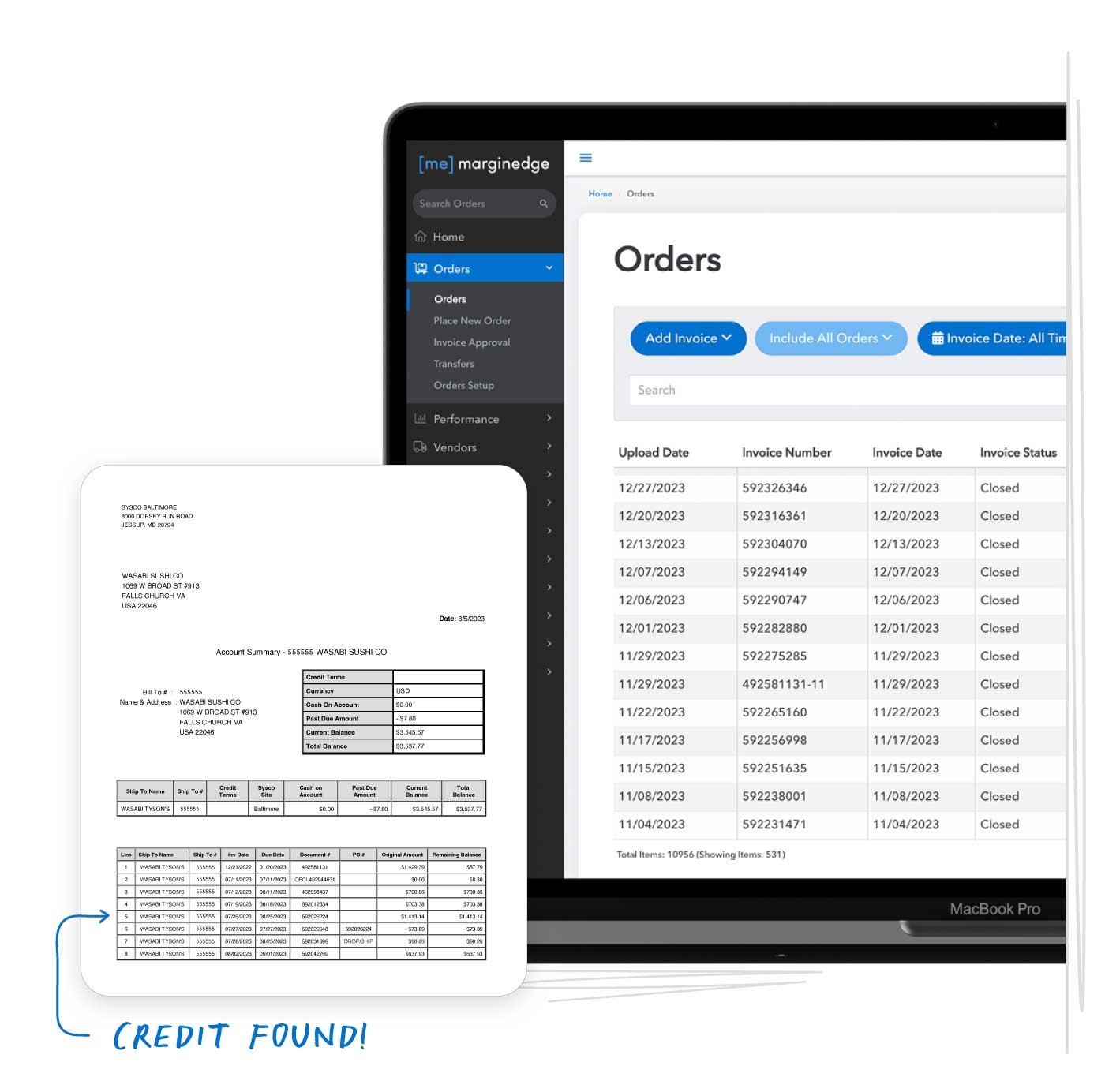

Pay the exact right amount, every time

Using [me] Bill Pay unlocks the power of vendor statement reconciliation. Quickly compare your vendors' order records with MarginEdge to ensure every credit is caught and invoice accounted for.

- Trust that your P&L is always accurate

- Confidently pay vendors - no accidental short payments or money left on the table

- Get all the benefits of vendor statement reconciliation, without doing all the work

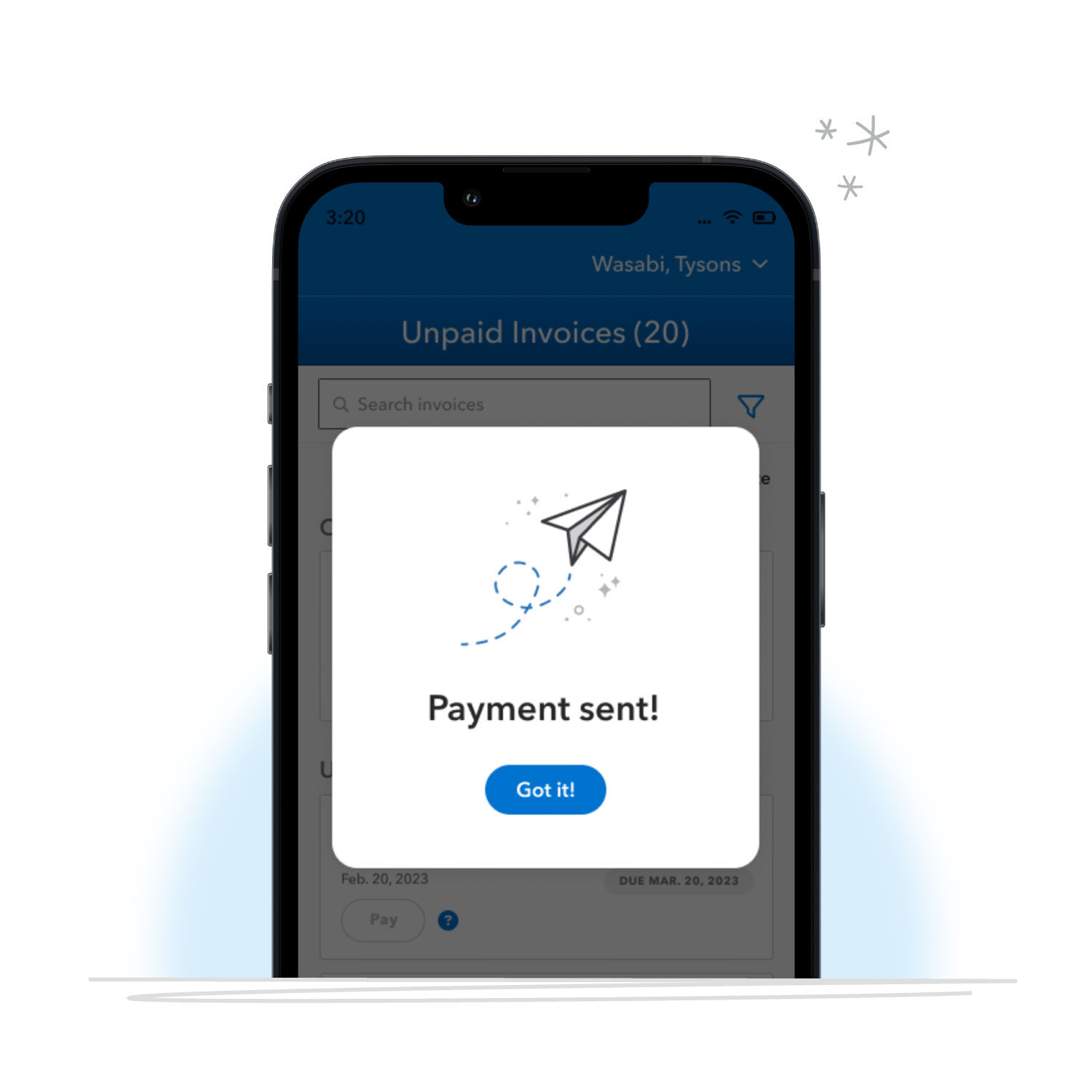

Get more without paying extra

We make it easy to pay unlimited bills through our restaurant-centric platform, at no extra cost. Never print, stuff, stamp or taste slightly sweet envelope glue again.

- Eliminate the time spent uploading and reentering your bills to yet another website (we've already got your AP!)

- Add an extra layer of oversight with payment approval rules

- Keep accounting in sync - push payment data to your accounting software as you go, or set it to run automatically

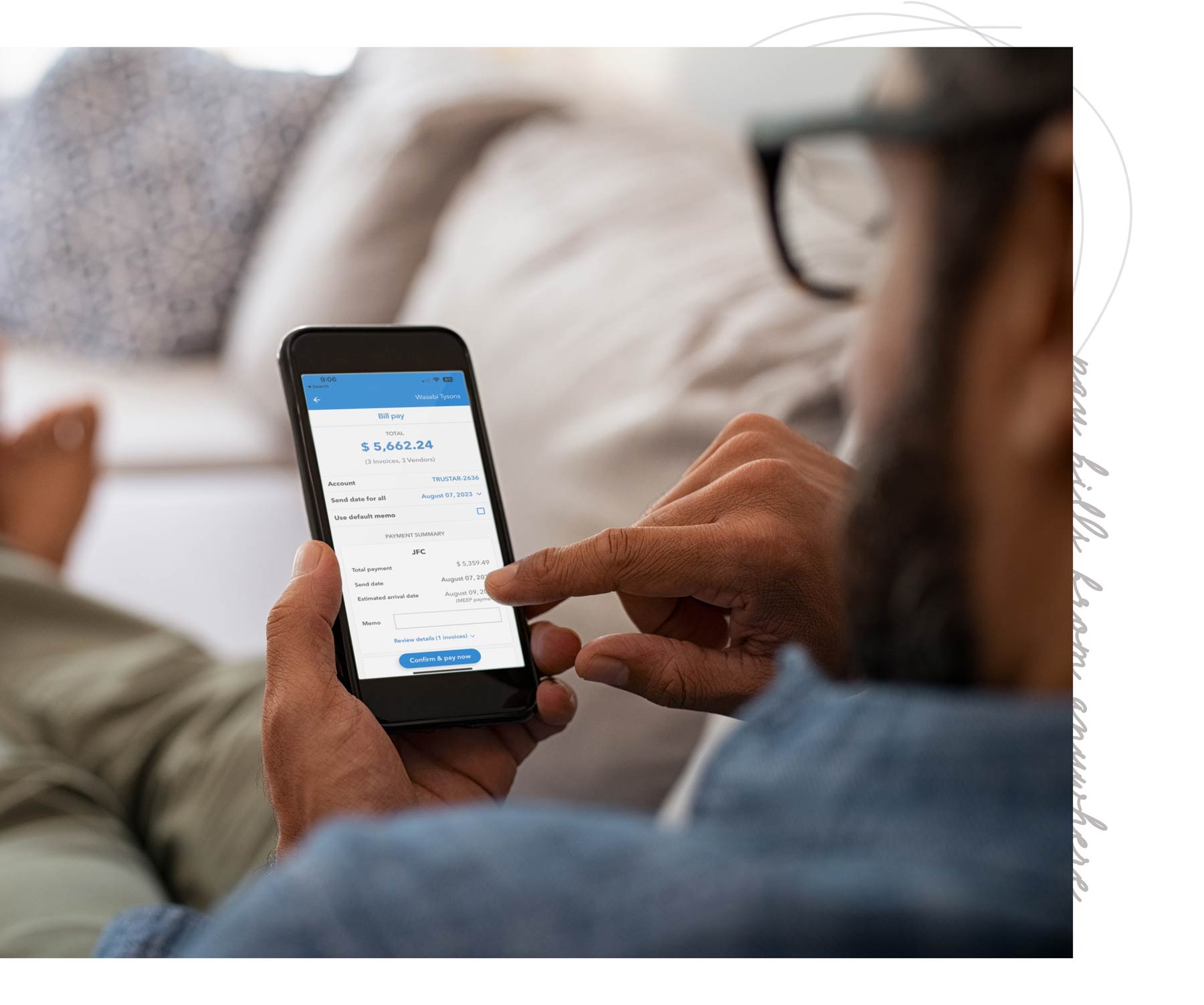

Let’s settle this outside the back office

On the floor? At a game? Waiting for an Uber? Our mobile app let's you pay vendors in between table visits, during halftime or on the road.

- Approve invoices in seconds

- Easily pay multiple vendors' bills at the same time

- Track payment status and send payment confirmation emails to your vendors

I was manually signing and physically mailing dozens of checks each week. Bill Pay was a game changer. The time savings alone has been 10 to 20 hours per week.

Tom Maroulakos

Co-Founder, Skopos Hospitality Group

"As a multi-unit operator, I would never go back to the old way of paying bills. MarginEdge Bill Pay is intuitive and user friendly, and I highly recommend it."

Dan Tufts

Director of Operations, Buffalo Wing Factory

Is there an additional charge to use Bill Pay?

Nope! Unlike other bill pay software, we don’t charge any fees to pay your bills.* Bill Pay is included in the cost of your MarginEdge subscription. In other words, if you have MarginEdge, you have Bill Pay, too!

As part of our robust bill payment platform, you also get Vendor Statement Reconciliation at no additional cost. We'll check your AP records against your vendors' to ensure you're P&L is always accurate and you always pay the exact right amount (no more, no less) every time.

*We offer the ability to use your own credit card to pay vendors (even if they don't accept cards!). This optional feature has a 2.99% fee per credit card transaction.

How long before a vendor receives my payment?

- Electronic payments (think ACH or Virtual Credit Card) are usually processed within 2-3 business days

- Paper checks can take up to 5 business days in the mail

- We also have an option to quickly pay vendors before you upload your invoice

My vendors only accept checks, can I still use Bill Pay?

Absolutely! We have a whole team devoted to writing checks on behalf of customers. We also cover the cost of the checks, envelopes, stamps and inevitable paper cuts, too.

What accounting systems does MarginEdge Bill Pay support?

MarginEdge Bill Pay functions independently from your accounting system so you can process payments regardless of your accounting system. Bill Pay currently syncs payment data to Quickbooks Online, Quickbooks Desktop (IIF and QWC), Intacct, Xero, Netsuite, Sage50, and Dillner’s Accounting Tools.

For these accounting systems, when you make a payment with Bill Pay, the payment details export to your accounting system and mark the relevant invoices as “Paid”.

For all other accounting systems, you can still use Bill Pay to send payments to your vendors. However, once you send a payment, you will need to manually enter the payment details into your accounting system to mark invoices as “Paid”.

Can I have multiple bank accounts set up for payments with Bill Pay?

Yes, you can have multiple bank accounts set up for Bill Pay payments and easily select invoices to be paid out of each.

What security measures do you have in place to protect financial data?

We host our software in the Amazon Web Services (AWS) cloud environment. All communication to and from our system follows industry-leading best practices, such as using encryption protocols for all communication. Bank account information is also encrypted at rest for extra security. We undergo annual penetration and security scanning, and periodically review and remove any outdated security protocols from our platform. Additionally, all changes to our software undergo a review by our security architecture team before being released.

How do electronic payments work?

We have partnered with a payments provider (ComData) that has thousands of vendors on their electronic payments network. When you submit a payment to a vendor on ComData’s network, we will automatically pay them electronically through VCC. If they are not on ComData’s network, we will automatically pay them with a physical check, and our vendor enrollment team will reach out to them to see if they would be willing to accept either VCC or ACH payments. Benefits to this method include faster speed, higher level of security and more visibility for you.