Important Stimulus Update & Daily Stats

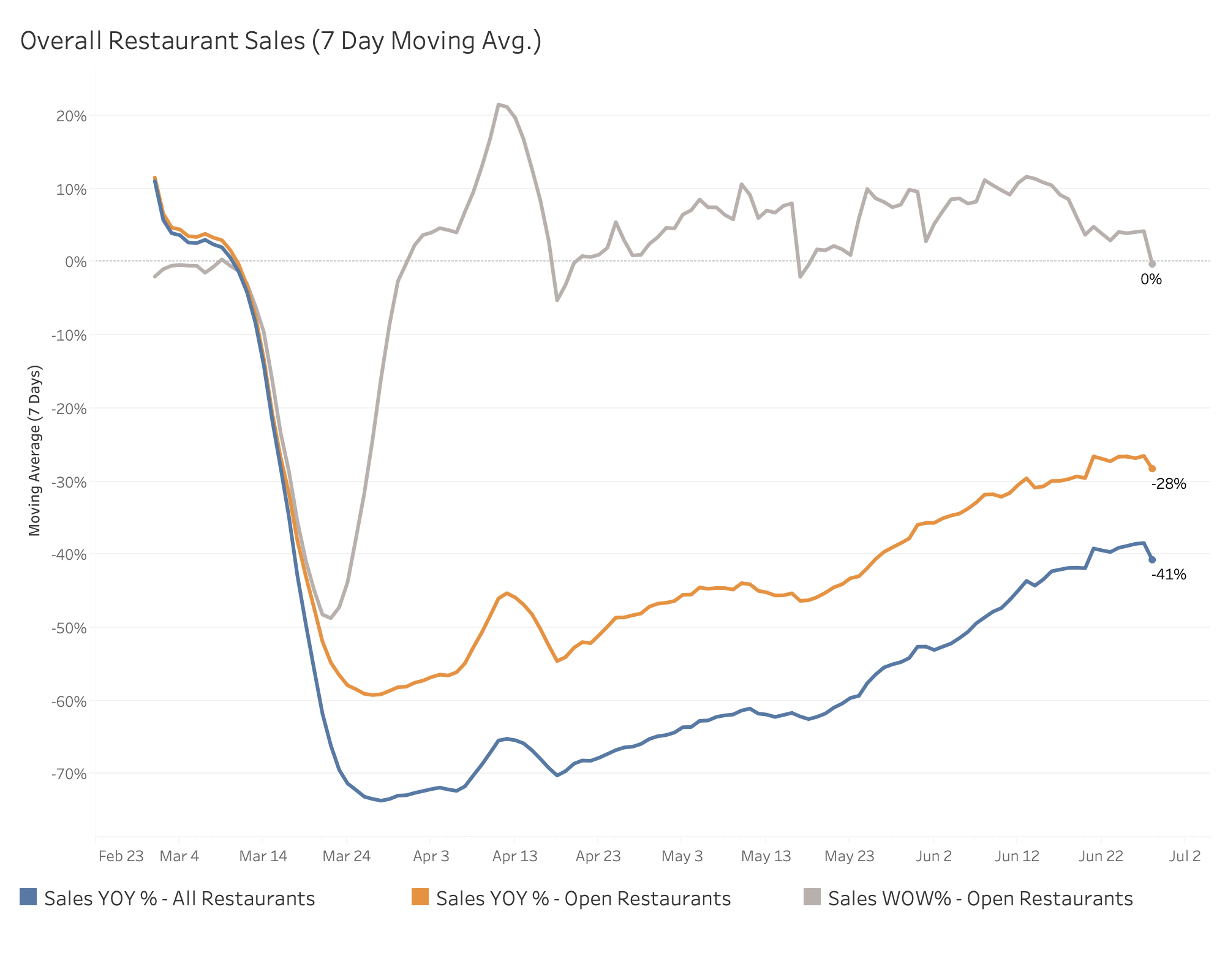

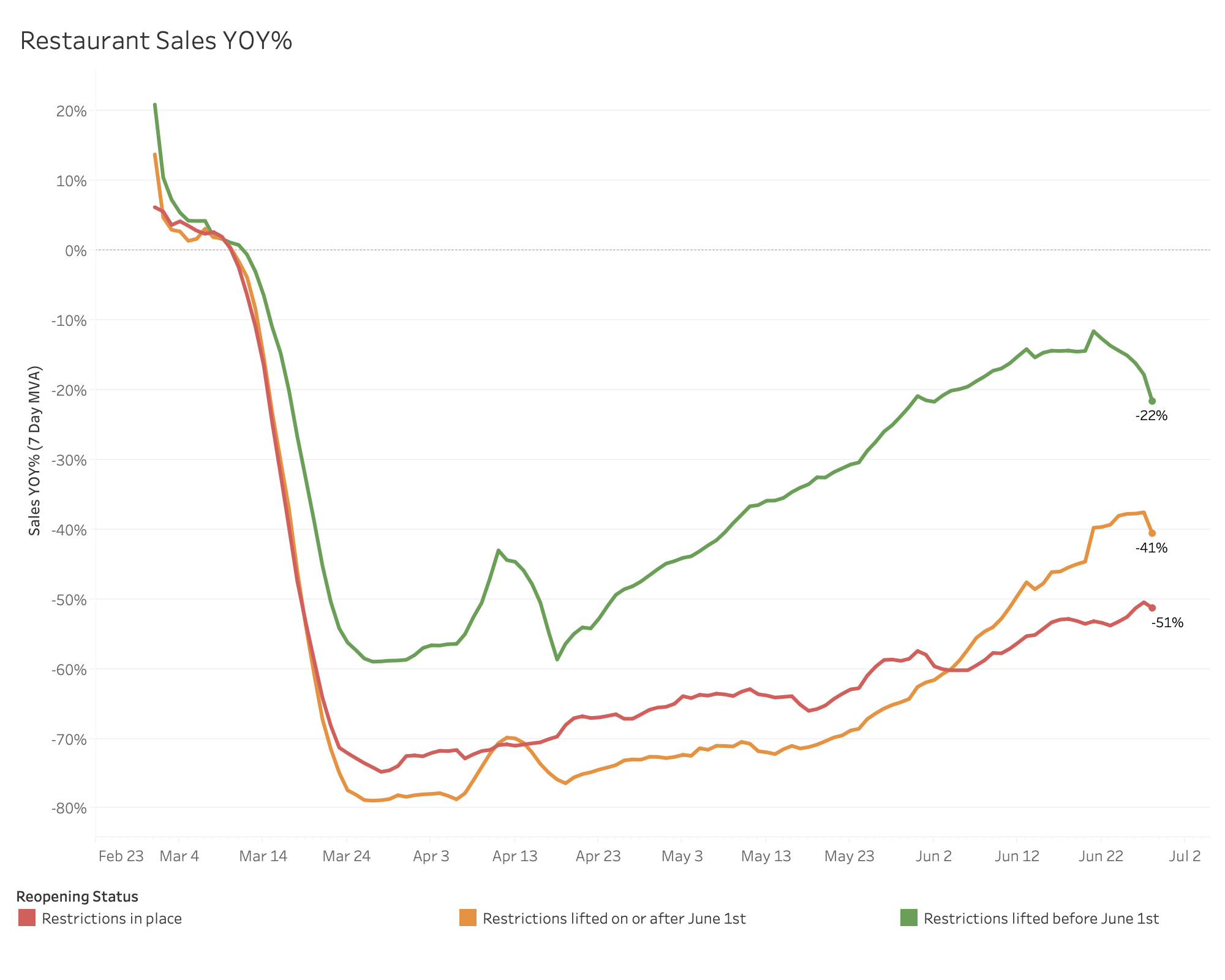

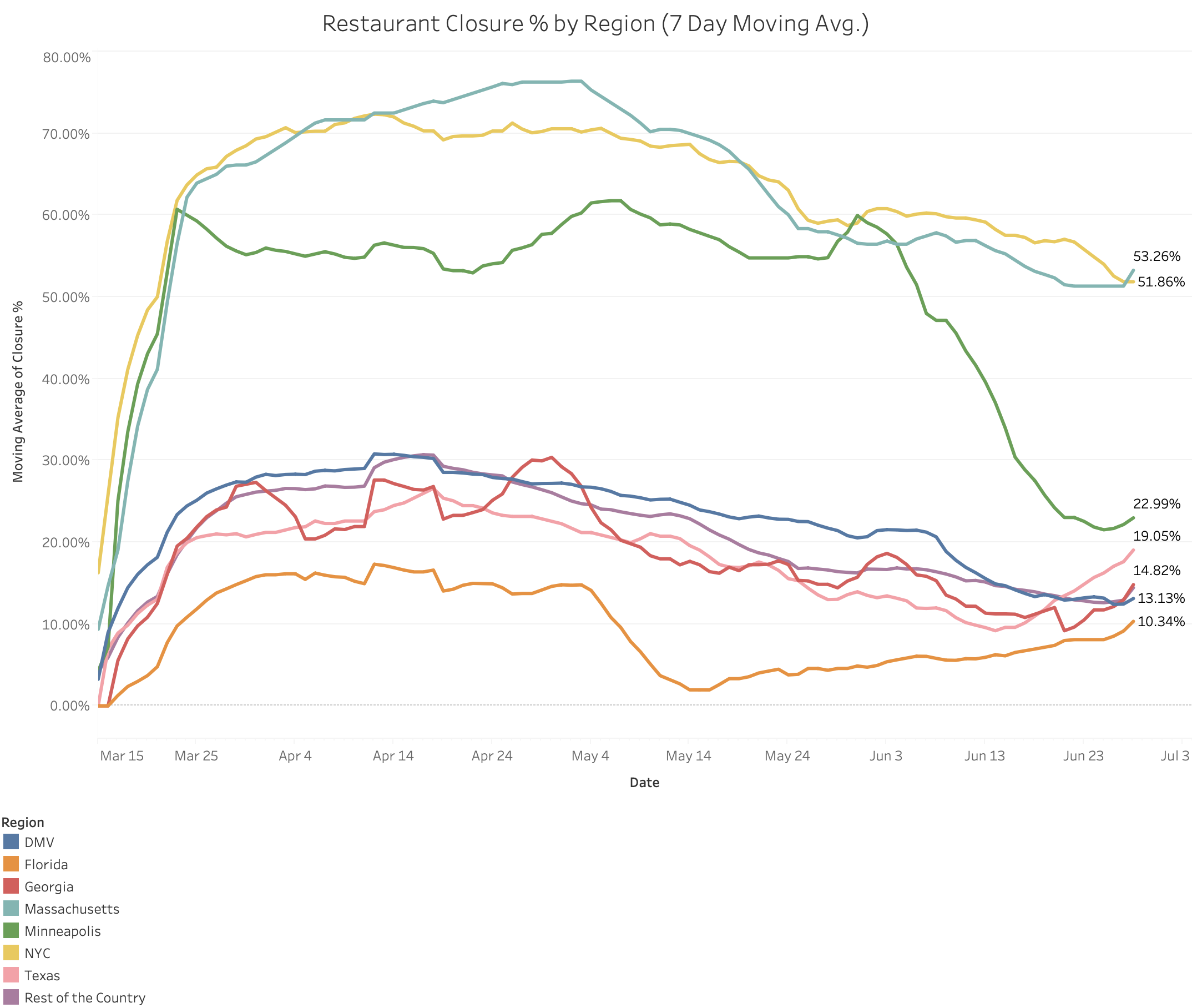

I have some good news related to the stimulus programs, but first, let’s get the bad news out of the way. Texas and Florida re-instituting closures is evident in the numbers. While our segment of restaurants that re-opened before June 1 reached -12% of YoY last week, they’re trending sharply lower at -22%. This group is seeing more COVID cases and therefore more closures.

Now for the good news. Around the time we were applying for PPP funding, there was discussion of another loan program – the Emergency Injury Disaster Loan from SBA. Back then, the SBA was overloaded with EIDL applications and stopped taking new ones. Fortunately, I just found out that they are accepting EIDL applications once again!

Similar to before, this is a bizarre process where you apply without actually saying how much you want to borrow. But for each of my restaurants it appears I will be receiving a $150k loan. This is a loan, not “forgivable debt”, like the PPP. But it is 3.75%, 30 years, no payment for the first year, and if it is under $200k it is not personally guaranteed. (((Small pointer, if you are applying for multiple restaurants, use a different email address per application as that will be your login name and it confuses the system to have two loans and 1 login name))).

Hope this is helpful!

Stay safe,

Bo

PS – For those following along on these notes, but are not a MarginEdge client, we would love to include your numbers in our data set and continue to build out the value of the reporting. We are giving our MarginEdge Lite product for free for the rest of the year for new clients (normally $15/month). This little tool connects your POS to accounting system and creates journal entries – hopefully time saving for you while increasing our sample size as we track recovery across our network. Obviously no obligation or commitment, just an offer for those interested!

Email Updates

Sign up to receive our emails for sales data, updates and resources as our community navigates Covid-19.

SIGN UP