Check or click: decoding restaurant bill payment types

In the bustling world of restaurants, impatient, hungry diners aren’t the only place where punctuality matters. Making timely payments to vendors plays a crucial role in a restaurant’s success.

Vendors rely on timely payments to sustain their businesses and ensure a steady supply of quality ingredients. By paying them promptly, restaurants foster strong relationships based on trust and mutual benefit.

Prompt payments also instill a positive reputation for the restaurant, reflecting professionalism and financial stability which, in turn, can encourage vendors to extend credit terms or offer exclusive deals, fostering a collaborative partnership. Additionally, timely payments prevent the accumulation of late fees, penalties, and damaged credit scores, saving restaurants from unnecessary financial strain.

Put simply, you gotta pay your bills!

But given everything you deal with on a daily basis in your restaurant, it can be hard to keep track of payments. You may have 20 different vendors with 20 different payment dates, and each one of them prefers a different payment method – checks, credit cards, wire payments, or that one morel guy that only takes cash.

What’s the best way to keep track of it all?

The answer (as with most things in the 21st century) lies with technology.

Cloud-based online restaurant bill payment platforms save operators time, streamline processes and (most importantly to some) get rid of that big pile of paper on your back office desk.

While online bill payment platforms have many benefits for restaurants, offloading vendor payments to a third-party platform can be a big step and not one operators typically take without deep consideration. Before considering an online bill pay platform, it is important to understand how these systems work and the types of payments that are used to ultimately pay your vendors.

This blog looks at the advantages of using an online bill payment platform, three common types of restaurant bill payments, when and why to use them and their benefits.

Understanding online restaurant bill payment types:

Why should restaurants use cloud-based online bill payment platforms?

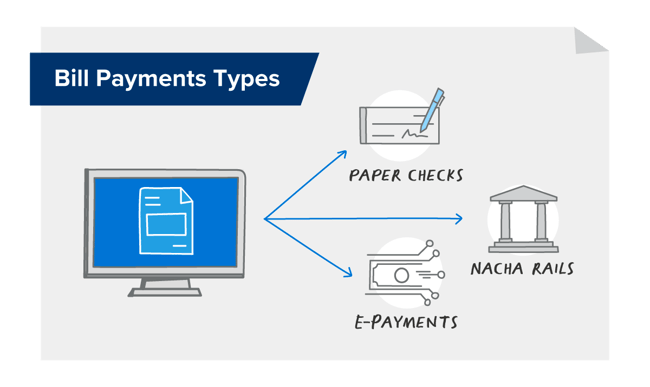

Types of restaurant bill payments:

Why should restaurants use cloud-based bill payment platforms?

Online bill payment platforms have become a game-changer for restaurants, providing many benefits.

They save you time

Firstly, these platforms offer convenience and efficiency by allowing restaurants to manage their bill payments anytime, anywhere, as long as there's an internet connection. They no longer need to rummage through piles of paperwork or manually input payment information. With just a few clicks, bills can be reviewed, approved, and paid seamlessly, saving time and reducing administrative burdens.

They make it easier to track expenses

Cloud-based platforms also provide a centralized hub for all payment-related activities, enabling easy tracking of expenses, generating reports and maintaining financial records. This streamlines accounting processes, making monitoring cash flow and informed financial decisions easier.

They are secure

Additionally, the cloud-based nature ensures data security, as information is stored on robust servers with encryption and authentication protocols giving restaurants peace of mind, knowing their sensitive financial data is protected from breaches or physical damage.

They integrate with your accounting system

Lastly, online bill payment platforms often offer integration with other accounting systems, enabling seamless data synchronization, reducing manual errors and promoting overall operational efficiency. In an industry where time is always in short supply, cloud-based online bill payment platforms serve up benefits that help restaurants thrive in a fast-paced, digital world.

Types of restaurant bill payments

An online bill platform allows you to make a variety of payments, depending on the preferred method of the vendor, from one centralized location. It is a game changer for operators who want to spend more time with guests, be able to help out the kitchen and front of house more often or even those who want to stop buying so many envelopes, stamps and checks.

1. Paper checks

What are they

Exactly what they sound like, paper checks are a way to make a payment using a piece of paper that tells your bank how much money you want to pay someone.

When to use them

Paper checks are used for payment when a vendor doesn’t accept electronic payment methods.

Pros

There's a certain charm to paper checks, reminiscent of getting a birthday card from your grandma with one of those bad boys stuffed inside. They offer a tangible form of payment and some businesses prefer paper checks due to familiarity or a lack of access to electronic payment systems.

Cons

Paper checks come with their fair share of drawbacks. For starters, they're prone to getting lost in the mail or misplaced, causing delays and frustration. Plus, there’s no way to know when the check is cashed until the money is taken out of your account, which is up to the discretion of the receiver. This can be good or bad for cash flow, depending on your restaurant’s needs and how much you like to live life on the edge.

There’s no effective way to track checks in the mail or ensure they are delivered in a specific time frame, which eliminates them as an option when it comes to rush payments.

Additionally, addresses have to be correct and verified before sending, which adds to processing time. Processing paper checks can also be time-consuming, requiring manual handling, depositing and clearing. Not to mention, without an online bill payment platform, the costs associated with printing and mailing paper checks can add up, making it an expensive option in the long run.

Bottom line

While some may argue that paper checks are going the way of the floppy disk, many vendors still rely on them, so they are a necessary method. Online bill payment platforms streamline paper check payments by printing and mailing them out for you, making managing them easier and saving you time and money. Your vendor still gets their check and you don’t have to taste any more of that envelope glue.

2. NACHA rails

What are they

NACHA Rails are the unsung heroes of the payment world. NACHA (National Automated Clearing House Association) is an organization in the United States that oversees the ACH (Automated Clearing House) network, which facilitates electronic payments, including ACH Rail payments. Think of an efficient and extensive plumbing system, but instead of transporting water, it seamlessly moves money from one bank account to another.

NACHA Rails work silently in the background, enabling automated and hassle-free transactions. They ensure that recurring payments, such as utility bills or loan installments, are effortlessly deducted from your account without any manual intervention – like having a dedicated team of invisible assistants handling your financial responsibilities. NACHA Rails streamline the payment process, saving time and reducing the chances of errors. Whichever bank you work with is who clears payments on your behalf.

When to use them

This, again, will depend on what your vendor wants and what they accept. Within the MarginEdge Bill Pay system, ACH payments ride on the fastest rails in the NACHA system so they take on average two days to go through and are a faster option compared to paper checks. Typical processing times for other NACHA payments can be anywhere from three to five days. Lastly, because ACH is an electronic option, it is great for automatic and recurring payments, which make your life a lot easier.

Pros

NACHA Rail payments offer convenience by allowing electronic transactions, eliminating the need for paper-based processes like writing checks or visiting physical banks. They are generally faster than traditional payment methods. Once initiated, the funds are electronically transferred between bank accounts, reducing processing and clearing times.

NACHA Rail payments can be automated, allowing for recurring payments and scheduling future transactions, which is beneficial for restaurants that have regular payment obligations for certain vendors.

NACHA Rail payments also follow strict security protocols, including encryption and authentication measures, to protect sensitive financial information. This helps mitigate the risk of fraud or unauthorized access to transaction data.

Cons

While NACHA Rail payments are faster than paper checks, they may still take a few business days to settle, especially for transactions involving different banks. This delay can be a drawback if immediate fund availability is crucial. They also rely on the stability and efficiency of the banking network. So, while rare, any disruptions or technical issues within the ACH system or participating banks can affect the processing and completion of transactions.

NACHA Rail payments primarily operate within the United States. International transactions may require alternative payment methods or additional intermediaries, which can add complexity and costs.

Once a NACHA Rail payment is initiated, it can be challenging to reverse or cancel the transaction. It's crucial to ensure the accuracy of payment details before initiating a transfer to avoid any unintended consequences.

Bottom line

NACHA Rail payments are a trackable, secure electronic method for paying your vendors. Whether or not your bill payment platform uses this method will depend on if your vendor accepts it. This method is also better suited for higher transaction volumes because it doesn’t require the manual effort of cutting paper checks.

3. Electronic payments (aka MEEPs)

What are they

MarginEdge Electronic Payments, or MEEPs, is a proprietary solution implementing smart routing to find the fastest payment type a vendor is willing to accept whether MEEPs, ACH or paper checks.

These payments are electronic and ride credit card rails, like Mastercard and Visa. So you can kind of think of them in the same way you think of using a credit card.

Because these payments ride the card rails, there's next-day funding to your vendor with the highest form of remittance. Remittance here is just a fancy schmancy word meaning the fastest payment with the most information included, i.e. invoice number it’s related to or credit it's being applied to. This means the payment gets to your vendor virtually as fast as if you swiped your credit card.

When to use them

These payments are by far the fastest of the three methods, as most payments are made the next day. MEEPs are just as safe and reliable as the NACHA rails, as they’re backed by high Tier 1 capital banks (aka they’re recognized as the strongest financial banks based on their core capital), and they provide more information to your vendors thanks to our rich remittance.

Pros

Electronic payments offer a host of advantages. First and foremost, they're fast and efficient, and can also be set up for automatic and recurring payments. With just a few clicks, funds can be transferred instantly, making them ideal for time-sensitive payments. Electronic payments also provide a digital trail, simplifying record-keeping and reducing the risk of human error. Moreover, they are often more secure than paper checks, with encryption and authentication protocols in place to safeguard sensitive information.

Cons

While rare, technology glitches and network outages can temporarily disrupt transactions. Some individuals may also have concerns about the security of their data, although stringent security measures are always in place, and MarginEdge never holds custody of your fiscal assets.

Vendors also have to be a part of the MEEPs network to make these types of transactions. That being said, the network is vendor mature, meaning we already have more than 60,000 vendors – everyone from the major broadliners to local purveyors, and we are adding hundreds of vendors a week.

Bottom line

You can’t beat the speed and ease of use when it comes to electronic payments for paying vendors. Every payment is tracked in the MarginEdge system from the time you submit an invoice, to when the money is credited to your vendors’ accounts. And because we capture all of the information from your invoices, including hand-written adjustments, you can be certain the amount you’re paying is correct. Lastly, our vendor network is restaurant-specific, and it is very simple to invite new vendors to join (because we handle onboarding them into it!).

While the choice of payment method ultimately depends on what your vendor accepts, having a cloud-based online bill payment tool for restaurants saves operators time, streamlines processes, keeps bills in one place and ultimately gives you peace of mind. Paying bills is stressful enough, so implementing an easier way to do it just makes good sense.