SBA + Daily Sales Stats: 3-17 Update

Today we have updates on the SBA Disaster Loans, a quick update on MarginEdge and year-over-year daily sales trends.

As you know, the SBA is rolling out a program to provide low-interest loans of up to $2M to small businesses that have been severely impacted by Coronavirus. These Disaster Loans are being made available on a state-by-state basis as they declare emergencies.

As of last night, states that have declared emergencies include California, Washington, Idaho, Oregon, Maine, New Hampshire, Connecticut, Massachusetts, New York, and Rhode Island, with additional states likely to follow suit.

These declarations can also occur at the county level, for instance Virginia has not declared but Fairfax County has, so I was able to apply last night for my restaurant in Tysons. The inverse is true for my restaurant in New England, Massachusetts has declared but Middlesex County has not so I can't apply yet for that location.

You can track whether your area is eligible here.

Once your area is eligible, you can apply for an SBA Disaster Loan here.

It appears the SBA Disaster Loans will be first-come, first-serve, so you will want to apply ASAP once they become available in your area. Here is what you can do now to prepare:

Gather three years of business and personal tax returns

- If you haven’t filed your 2019 taxes make sure you have your end-of-year financials.

Prepare the following required forms:

- SBA Form 413D: Personal Financial Statement (link here)

- IRS Form 4506T: Disaster Request for Transcript of Tax Return (link here)

- SBA Form 2202: Business Debt Schedule of all current debts (link here)

Right now, we don’t know how long it will take for the SBA to process Disaster Loan applications. Historically, disaster loans processed and issued by the government (as opposed to a partner lender, as is done for traditional SBA loans) have taken months.

Also as a quick update about MarginEdge, we have had a few questions from our customers so we wanted to let you know that we are operating normally. We want to support our customers through this unprecedented time so our lights are on, our team is working (invoices and bill pay as usual) and we plan to keep it that way.

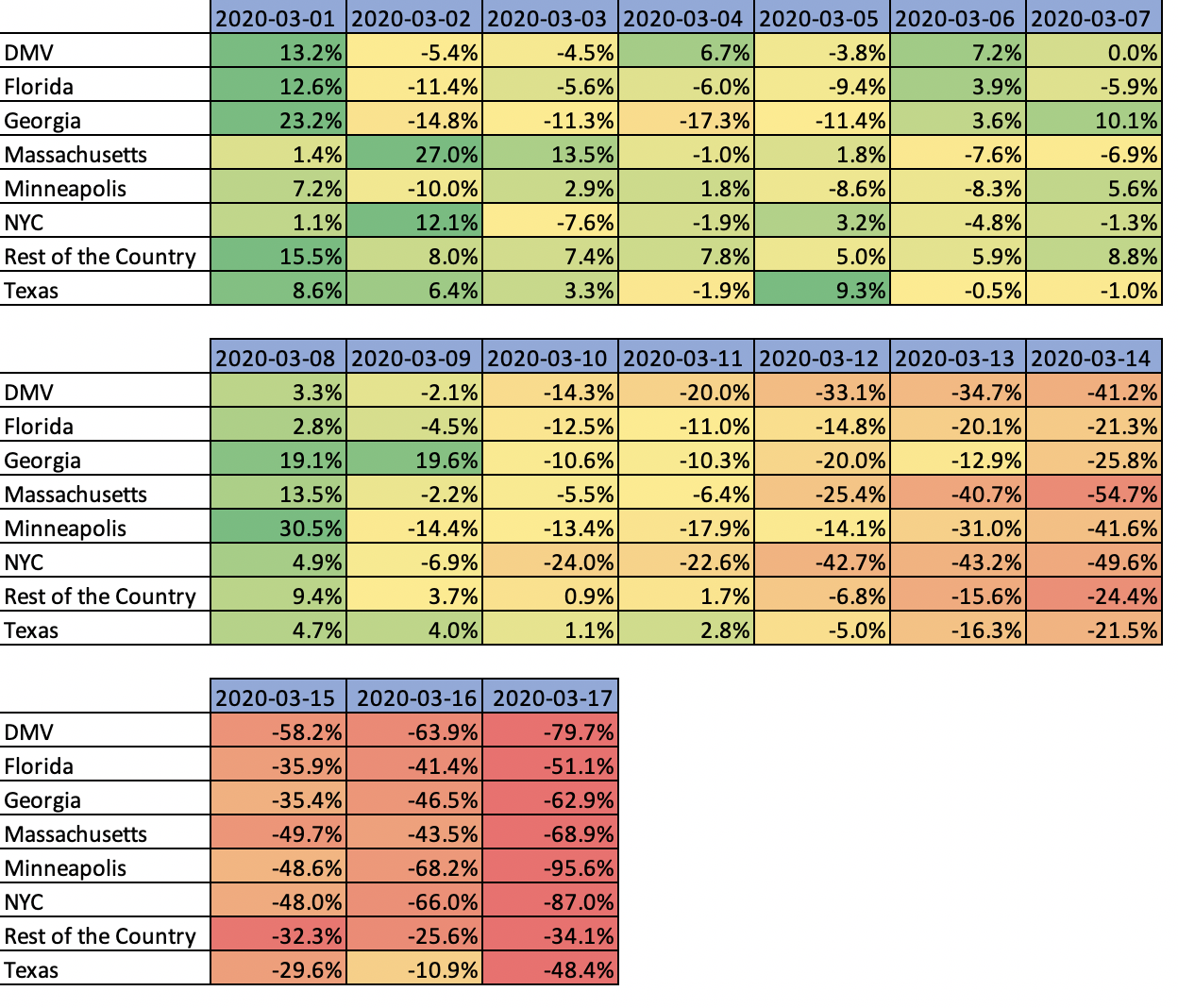

Lastly, you will find our roundup of year-over-year daily sales stats attached below. Just a reminder that to provide support to restaurants across the country, and to help build our data set, we are offering our basic product (pulls sales data from your POS and pushes into accounting) for free for 90 days. No contract or anything like that, just a tool we hope our community takes advantage of over the next few months.

Please keep us posted with anything we can do for you or your business.

Stay safe,

Bo