Restaurant bookkeeping & accounting pain points: what operators should know

The relationship between operators and their bookkeepers and accountants involves a lot of communication and trust. At their best, they keep restaurants profitable, healthy, and free from any surprise visits from the IRS (or at least free from panicking if they do show up).

Like any relationship, open communication is key; however, this can be difficult as restaurant operators often work non-traditional hours and have very little free time to jump on a call and run through the numbers every week. There will always be those little annoyances that can build up over time and turn into bigger issues if not expressed and managed.

Sometimes the best way to make sure you’re holding up your end of the relationship is to understand your partner’s grievances. As Mr. Rogers always said, “If it’s mentionable, it’s manageable.” Knowing what you’re up against is the first step in making sometimes tricky situations better.

And since we’re all about helping restaurant operators, we sat down with our controller in residence, Christian Guidi, who has seen it all and done it all in his decades-long career in the industry, including being a general manager and controller for Clyde's Restaurant Group in Washington, D.C. We asked Christian about the pain points with restaurant bookkeeping and how operators can help make them a little less… well, painful. Here are four ways operators can help their restaurant bookkeepers and accounting teams.

Four ways restaurant operators can help make their bookkeepers' and accounting teams’ lives easier:

1. Streamline the process of getting invoices into accounting

Invoices are at the heart of understanding a restaurant’s profitability and so they deserve a little more respect than just being piled onto the back-office desk. Christian says, “If you want to make your accounting team’s life easier, streamline how you get your invoices to your accountant or bookkeeper.”

This can be done with automated invoice processing software, or if you’re not ready to jump into a new piece of restaurant technology, by making sure invoices are sent to more than one person. Christian notes, “What happens if your bookkeeper goes on vacation, and they’re the only person you send invoices to? Sending to at least one other person creates redundancy while also increasing accuracy and accountability.”

Invoice processing software automatically sends invoices to your accounting system fully coded, requiring no manual entry (just a few checks here and there). This software also creates photocopies of the invoices which can be referenced in the case of discrepancies or (everyone’s favorite) audits. Some invoice processing software also offers mobile apps which can be downloaded by anyone on your team so invoices are uploaded as soon as they come in the back door.

Invoice processing software automatically sends invoices to your accounting system fully coded, requiring no manual entry (just a few checks here and there). This software also creates photocopies of the invoices which can be referenced in the case of discrepancies or (everyone’s favorite) audits. Some invoice processing software also offers mobile apps which can be downloaded by anyone on your team so invoices are uploaded as soon as they come in the back door.

Setting up processes can be daunting. Routines can be difficult to start and maintain, especially when you’re used to doing something the same way for years or even decades. The truth is, how to profitably run a restaurant has changed (along with nearly everything else in the business), and restaurant tech isn’t the evil time-suck it’s been in the past. Plus, with the influence of AI and machine learning, it’s only going to get better.

2. Track everything with your POS

The second pain point Christian tells us your bookkeeper wishes you knew about is inconsistent POS usage. “Just like having a consistent process for getting your invoices into accounting, consistent POS use for everything – really, everything – is incredibly helpful for your bookkeeper,” he says.

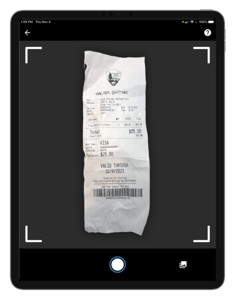

Things like petty cash, third-party delivery orders, and gift cards should be recorded with your POS. Not only does this keep data coming from one place as opposed to many, but it also creates a transaction that can then be reconciled with an invoice or receipt. So when you upload that receipt from 7-Eleven because you ran out of 2%, there’s a transaction showing the reimbursement from petty cash was paid out. No more random receipts or sketchy transactions from a month ago that no one remembers anymore.

Things like petty cash, third-party delivery orders, and gift cards should be recorded with your POS. Not only does this keep data coming from one place as opposed to many, but it also creates a transaction that can then be reconciled with an invoice or receipt. So when you upload that receipt from 7-Eleven because you ran out of 2%, there’s a transaction showing the reimbursement from petty cash was paid out. No more random receipts or sketchy transactions from a month ago that no one remembers anymore.

If you’re using a restaurant management system to automatically connect your POS to your accounting system, this process is even easier because there’s no manual entry. It also makes it easy to reconcile expected credit card and cash deposits with what actually hits the bank on a daily basis to ensure your cash is under control.

3. Don’t dump invoices at the end of the month

You know when the kitchen has a rush and your servers send in all their tickets at once instead of putting the orders in as they come or spacing them out between appetizers and entrees? How much does your kitchen team just love when that happens? Depending on how much Red Bull they need to burn off, they probably don’t love it. Turns out, invoices aren’t so different from orders for your bookkeeper!

Christian explains, “When operators wait to send in all their invoices at the end of the month, it becomes incredibly difficult for bookkeepers and accountants to enter everything in and produce reports in a timely manner.” Many operators get reports like a P&L back 2-3 weeks after the period ends, which at that point, you can’t do much with in terms of righting the ship if something’s wrong.

Sending in invoices as you get them is the best way to keep your bookkeeper happy and give yourself a better chance of knowing what’s going on financially in a timely manner. Instead of having 50-100 invoices to hand-enter under a quick turnaround time, they can space them out and stay better organized. Depending on your accounting services, you may also be able to see how your spending is doing mid-way through the period so you can cut back if need be while you still can.

With an automated invoice processing system, this is even easier! Not only do your bookkeeper and accountant have access to your invoice data consistently throughout the month, but you as an operator do too. Consistent invoice uploading lets you view a near real-time daily P&L.

So if the cost of eggs skyrockets again, you can catch it as soon as the invoice is processed, and make an adjustment before your omelet food costs are at 45%.

4. Maintain a centralized source of truth

This pain point is somewhat of an amalgamation of each pain point listed above but deserves its own section nonetheless. Not having a centralized source of truth is a major headache for not only your bookkeeper but probably you and the rest of your in-house team too.

How many times have you had to double and triple-check numbers because the amounts you have on your Excel spreadsheet don’t match what your bookkeeper has in their system? They have to dig through to find the invoice (assuming it's not also missing), the books aren’t balanced and it's a huge headache for everyone involved when both sides don’t say the same thing.

Having one place where both you as an operator and your bookkeeper/accounting team go for information is crucial. Realistically, the easiest way to do this is with a cloud-based Restaurant Management System or invoice processing system that captures the image (either from a picture, scan, or email) of your invoices and stores them digitally.

Line item data from your invoices are pushed automatically with the help of AI, so human error from manual data entry is eliminated. And since AI is incredibly helpful but not quite perfect, MarginEdge uses a combination of AI and human eyeballs. This ensures the data is more accurate while still saving time.

Christian notes, “It also limits the amount of back-and-forth communication needed because the POS data should flow into accounting and both the operator and the accountant are looking at the same numbers from the same place.” If only Tylenol got rid of headaches that quickly.

While this list is certainly not exhaustive, it hopefully sheds some light on operator-bookkeeper relations, and how to keep things fun, fresh, and not so frustrating. It all comes down to lessening the amount of work both teams have to do and an automated system will more often than not be the answer. Not sure what to look for? Check out our blog on 7 things to look for in a restaurant management system.

![[Sign up for our newsletter] Get sales data and restaurant insights straight to your inbox each month](https://no-cache.hubspot.com/cta/default/6423873/2b19fcb4-92a7-41e5-8a2f-75a74dad0c24.png)